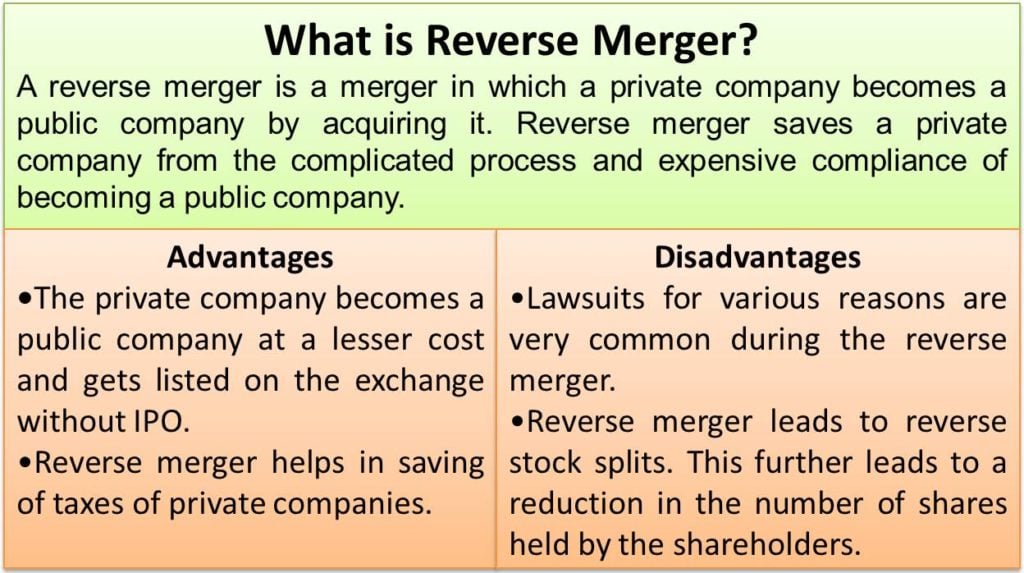

Not as dependent on market conditions.Because they don’t involve paying fees to financial institutions and take less time to complete, reverse mergers cost less than IPOs.

Instead, the deal is between two parties-the public company and the private company. Unlike IPOs, reverse mergers don’t require an investment bank to serve as an underwriter. Reverse mergers take one to three months to complete while IPOs often take six months or longer. The Securities and Exchange Commission (SEC) has highlighted the fraud risks posed by some reverse mergers, warning that the public companies emerging from a reverse merger can fail or otherwise struggle to remain viable. “Besides, reverse mergers typically end up unsuccessful as most companies turn to them when they can’t raise money in private markets, and they don’t generate enough interest for an IPO.” “Compliance and fraud risks of a shell company are huge issues in reverse mergers, and a ton of diligence is needed,” says Kyle Asman, managing partner of Backswing Ventures, a venture fund based in Orlando, Fla. Given the lower levels of regulatory oversight and smaller number of investors involved in a deal, the risk of fraudulent or unethical reverse mergers is very real. That’s why they can be completed more quickly: There’s no need to drum up publicity for the deal and catch the attention of institutional or retail investors. Unlike a conventional IPO, there is no new capital raised during a reverse merger. The private company then ends up as a wholly owned subsidiary of the shell company. Once they own a majority stake, they swap the shares of the private company for existing or new shares of the public shell company. The first step in a reverse merger is for the owners of the public company to buy at least 51% of the shares of a shell company. These are called “shell companies,” and they are the usual targets of reverse mergers. There are many public companies with shares listed on public stock exchanges-typically over-the-counter (OTC) markets-that have few to no ongoing operations or assets. This is especially important for companies that might not have the funding or abilities to handle an official IPO. What’s more, even after all of that, unfavorable market conditions beyond any company’s control can complicate if, or when, an IPO happens.īut none of the costs and complications of a standard IPO apply in a reverse merger, which means they provide private companies a quick way to go public. There’s also an extensive due diligence process, tons of paperwork and regulatory reviews. IPOs, however, are complicated, time-consuming endeavors and usually involve hiring an investment bank to underwrite the deal and issue shares. Traditionally, this is done through an initial public offering, or IPO. Companies sell shares to the general investing public to raise their name recognition and access more sources of financing than are generally available to private firms. Why Do Companies Choose a Reverse Merger?įirst, it’s important to understand why a company may choose to go public to begin with.

0 kommentar(er)

0 kommentar(er)